Mastering the Wallnut: 5 Strategic Steps to Financial Freedom

The acorn doesn’t become an oak overnight. Similarly, financial freedom isn’t a sudden windfall; it’s a meticulously cultivated growth. We call this growth the “Wallnut Strategy,” a blend of strategic planning and consistent action, drawing inspiration from the enduring strength and resilience of the walnut tree. This isn’t about get-rich-quick schemes; it’s about building a robust, long-term financial foundation.

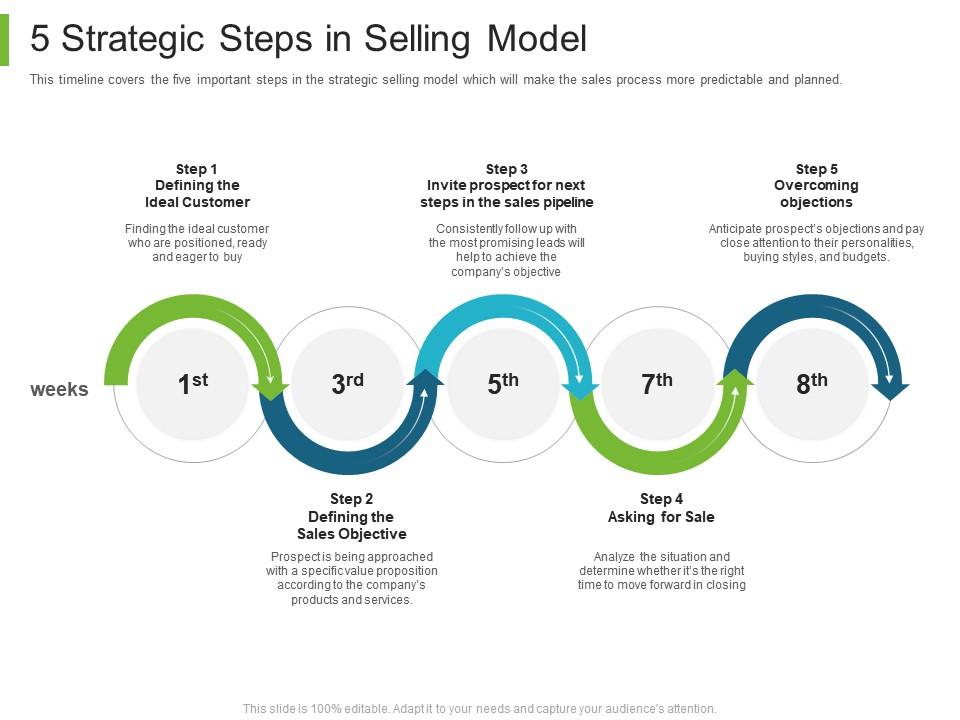

Step 1: Planting the Seed: Defining Your Financial Goals

Before you even think about investing, you need a clear vision. What does financial freedom look like for *you*? Is it early retirement? Owning a home? Funding your children’s education? Define specific, measurable, achievable, relevant, and time-bound (SMART) goals. Without a destination, you’ll be wandering aimlessly.

Consider creating a vision board or writing a detailed financial plan. Break down your larger goals into smaller, manageable milestones. This makes the journey less daunting and provides a sense of accomplishment along the way. For example, instead of “become financially independent,” aim for “save $10,000 in the next year” or “pay off $5,000 of credit card debt within six months.”

Step 2: Nurturing the Sapling: Budgeting and Debt Management

A young sapling needs careful nurturing to thrive. Similarly, your financial journey requires a well-structured budget. Track your income and expenses meticulously. Identify areas where you can cut back and redirect those funds toward your goals. Don’t shy away from using budgeting apps or spreadsheets – technology can be a powerful ally in this process.

| Expense Category | Action |

|---|---|

| Dining Out | Reduce frequency; cook more meals at home. |

| Entertainment | Explore free or low-cost activities. |

| Subscriptions | Cancel unused services. |

Debt management is crucial. Prioritize paying down high-interest debt, such as credit card debt, while strategically managing lower-interest loans. Explore options like debt consolidation or balance transfers to potentially lower your interest rates.

Step 3: Providing Sunlight: Investing Wisely

Once your financial soil is prepared (through budgeting and debt management), it’s time to expose your investments to the “sunlight” of growth. Diversify your portfolio across different asset classes like stocks, bonds, and real estate, based on your risk tolerance and time horizon. Remember, investing involves risk, and there’s no guarantee of returns. Consider consulting with a financial advisor for personalized guidance.

Step 4: Protecting from Pests: Insurance and Risk Management

No matter how diligently you nurture your financial growth, unexpected events can threaten it. Insurance acts as a protective shield against potential setbacks. Ensure you have adequate health, life, disability, and property insurance to safeguard your financial well-being. Consider an emergency fund as a buffer against unforeseen circumstances.

Step 5: Harvesting the Wallnuts: Review and Adapt

The harvest is not a one-time event. Regularly review your progress toward your goals. Life circumstances change, and so should your financial strategy. Adapt your budget, investment portfolio, and debt management plan as needed. This ongoing process of evaluation and adjustment ensures your financial tree continues to bear fruit for years to come.

Mastering the Wallnut Strategy is a marathon, not a sprint. It requires patience, discipline, and consistent effort. But by following these five steps, you’ll be well on your way to building a strong, resilient financial foundation that will ultimately lead to the financial freedom you desire.

Additional Information

Mastering the Wallnut: A Deeper Dive into Strategic Financial Freedom

The concept of “Mastering the Wallnut” – implying the diligent and strategic breaking down of financial obstacles to achieve freedom – requires a nuanced understanding beyond simply five steps. While a five-step framework can provide a useful roadmap, true mastery involves a deeper dive into the complexities of financial planning and behavioral economics. Let’s analyze each potential step in more detail, considering potential pitfalls and advanced strategies.

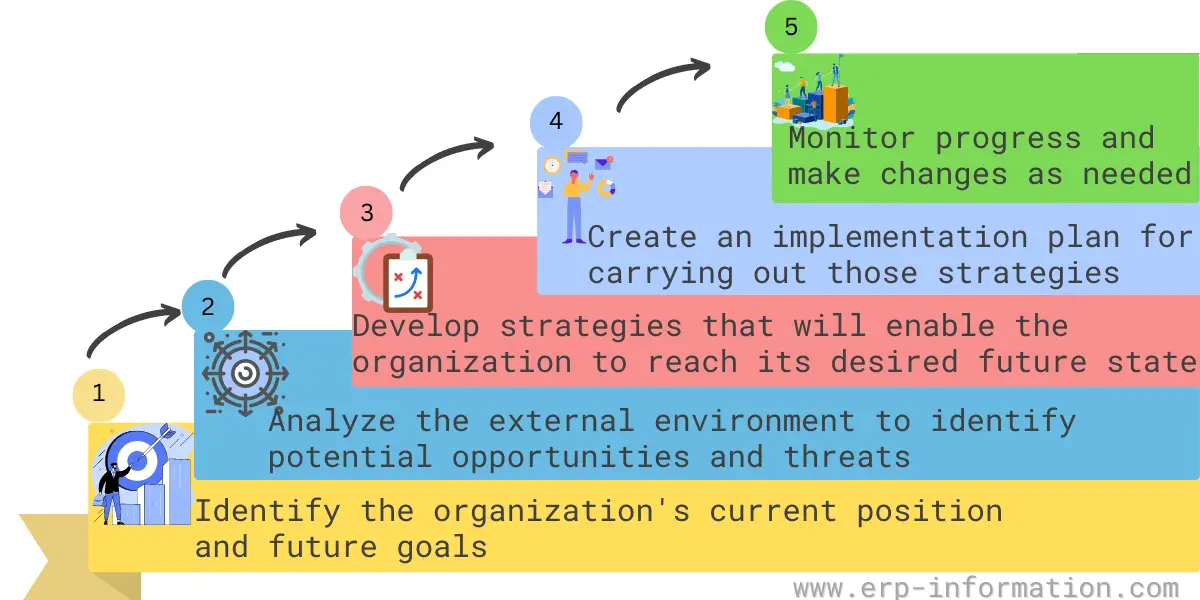

1. Comprehensive Financial Assessment: Beyond Budgeting. A simple budget is insufficient. A true assessment requires:

- Net Worth Calculation: This goes beyond assets; it includes liabilities and provides a holistic view of your financial health. For example, someone with a high-income but significant debt (mortgages, student loans, credit card debt) may have a low net worth, hindering their path to freedom.

- Cash Flow Analysis: Tracking income and expenses over several months reveals spending patterns and identifies areas for improvement. Software like Mint or YNAB can automate this.

- Debt Analysis: Understanding interest rates, repayment terms, and the overall burden of debt is critical. Prioritizing high-interest debt (like credit cards) using strategies like the debt snowball or avalanche method can significantly impact long-term financial health. Statistics show that high-interest debt can cripple savings and investment growth.

- Risk Tolerance Assessment: Understanding your comfort level with risk is crucial for investment decisions. A questionnaire or consultation with a financial advisor can determine your appropriate risk profile.

2. Goal Setting and Prioritization: Beyond Generic Aspirations. Financial freedom isn’t a monolithic concept. It must be defined personally.

- SMART Goals: Goals should be Specific, Measurable, Achievable, Relevant, and Time-bound. Instead of “financial freedom,” set goals like “retire with $2 million by age 65” or “pay off my mortgage in 10 years.”

- Prioritization Matrix: Use a matrix (like Eisenhower’s Urgent/Important) to prioritize financial goals. Paying off high-interest debt might be urgent and important, while investing for retirement may be important but less urgent in the short term.

- Contingency Planning: Unexpected events (job loss, medical emergencies) can derail progress. Building an emergency fund (3-6 months of living expenses) is crucial.

3. Strategic Debt Management: Beyond Simple Repayment.

- Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate can simplify repayment and potentially save money. However, carefully consider the terms and fees involved.

- Negotiation: Contacting creditors directly to negotiate lower interest rates or payment plans can be effective, particularly if you have a history of timely payments.

- Debt Settlement: This should be a last resort, as it negatively impacts credit scores. However, it might be beneficial in extreme situations.

4. Aggressive Savings and Investment: Beyond “Saving More”.

- Automated Savings: Setting up automatic transfers from your checking account to a savings or investment account ensures consistent savings.

- Investment Diversification: Don’t put all your eggs in one basket. Diversify across different asset classes (stocks, bonds, real estate) to reduce risk. Modern Portfolio Theory provides a framework for optimal diversification.

- Tax-Advantaged Accounts: Utilize IRAs, 401(k)s, and other tax-advantaged accounts to maximize investment returns and minimize tax burdens. Understanding tax implications is crucial for long-term financial success.

5. Continuous Learning and Adaptation: Beyond a One-Time Effort.

- Financial Literacy: Continuously expand your knowledge of personal finance through books, courses, and workshops.

- Market Monitoring: Stay informed about economic trends and market fluctuations to adjust your investment strategy accordingly.

- Professional Guidance: Consider consulting a financial advisor for personalized advice and support, particularly for complex financial situations. A financial advisor can provide valuable insights and help navigate intricate financial planning aspects that are beyond the scope of basic self-education.

Case Study: Consider two individuals, both earning $100,000 annually. One spends lavishly, accumulating significant debt, while the other meticulously saves and invests, prioritizing long-term goals. Over 20 years, the latter will likely achieve substantial financial freedom while the former might struggle to break even. This illustrates the importance of disciplined financial behavior and strategic planning.

In conclusion, “Mastering the Wallnut” requires more than just five steps; it necessitates a comprehensive, ongoing commitment to financial literacy, strategic planning, and disciplined execution. By delving into the complexities discussed above, individuals can significantly improve their chances of achieving genuine financial freedom.