Short-Term Wallnut Investing Strategies: Maximizing Returns in a Changing Market

The allure of quick profits in the volatile world of short-term investing is undeniable. But navigating this landscape requires more than just gut feeling; it demands a strategic approach tailored to the ever-shifting market conditions. This isn’t about get-rich-quick schemes; it’s about intelligent, calculated moves designed to maximize returns within a defined timeframe. Let’s delve into the world of short-term “wallnut” investing – a playful term representing the rapid, sometimes unpredictable nature of these strategies.

Understanding the Wallnut’s Shell: Short-Term Investing Defined

Short-term investing, in the context of “wallnuts,” focuses on holding assets for periods ranging from a few days to a year. Unlike long-term strategies prioritizing slow, steady growth, wallnut investing embraces shorter time horizons, often capitalizing on market fluctuations and specific opportunities. This approach demands a higher risk tolerance and a keen understanding of market dynamics. Think of it as cracking open a wallnut – sometimes you get a delicious kernel, sometimes the shell is harder to break than anticipated.

Cracking the Code: Key Short-Term Wallnut Strategies

Several strategies can be employed within the short-term wallnut approach, each carrying its own level of risk and reward:

1. Swing Trading: Riding the Waves

Swing trading involves capitalizing on short-term price movements. Traders identify assets poised for a significant price swing (up or down) and hold them for a few days or weeks. Technical analysis, chart patterns, and momentum indicators are crucial tools. This strategy demands constant market monitoring and a willingness to adjust positions quickly.

2. Day Trading: The High-Frequency Hustle

Day trading is the most intense form of short-term investing, where positions are opened and closed within a single trading day. It requires lightning-fast reflexes, deep market understanding, and advanced technical skills. High leverage is often involved, magnifying both profits and losses. This is definitely not for the faint of heart.

3. Scalping: Sniping Small Profits

Scalping focuses on profiting from minuscule price fluctuations. Traders execute numerous trades throughout the day, aiming for small gains on each transaction. Volume and speed are paramount; success relies on capturing even the tiniest price movements. While potentially high-frequency, the overall profit margin per trade is slim.

The Nuts and Bolts: Tools and Considerations

Successful wallnut investing requires more than just selecting a strategy. It necessitates a robust toolkit and a realistic understanding of the risks involved:

| Tool | Purpose |

|---|---|

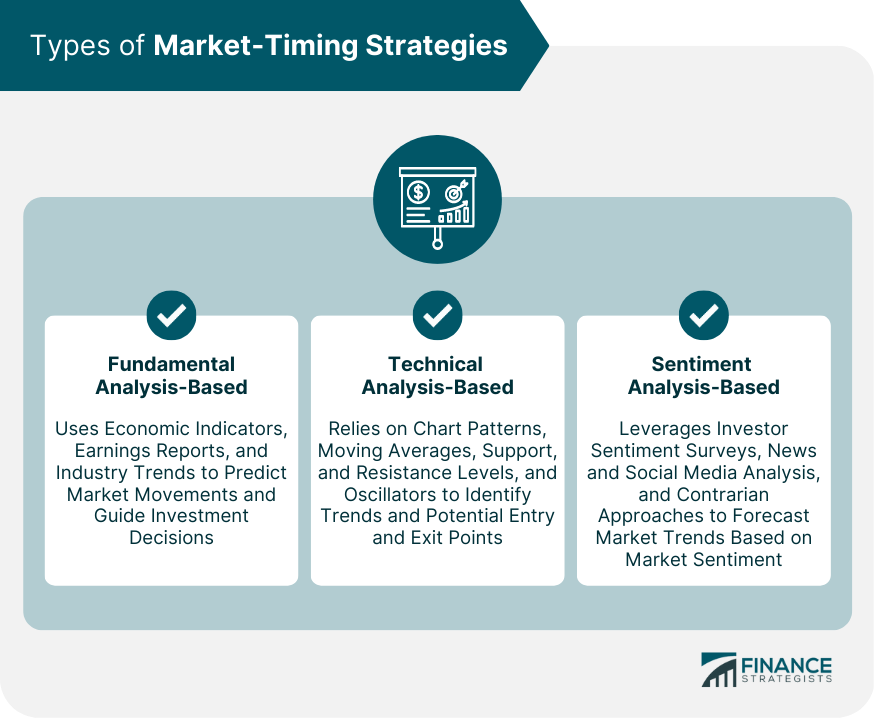

| Technical Analysis | Identifying trends and patterns |

| Fundamental Analysis | Assessing underlying asset value |

| Risk Management | Protecting capital from significant losses |

| Diversification | Reducing overall portfolio risk |

Risk Management: This is paramount. Short-term strategies are inherently riskier. Setting stop-loss orders, diversifying investments, and never investing more than you can afford to lose are critical.

Adapting to the Changing Market: The Agile Wallnut

The market is constantly evolving. What worked yesterday might not work today. Therefore, an agile approach is crucial for successful wallnut investing. Stay informed about economic indicators, geopolitical events, and industry news. Be prepared to adjust your strategies based on new information and market trends. Flexibility is key to navigating the unpredictable nature of short-term investments.

The Sweet Reward: Maximizing Returns

While risk is inherent, well-executed wallnut investing strategies can yield significant returns. By carefully selecting strategies, employing effective risk management, and adapting to market changes, investors can maximize their chances of cracking open those profitable wallnuts. Remember, though, that consistent profitability requires discipline, knowledge, and a healthy dose of patience, even within the short-term framework.

Disclaimer:

This article is for informational purposes only and should not be considered financial advice. Investing involves risk, and it’s crucial to conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Additional Information

Deep Dive: Short-Term Wallnut Investing Strategies – Maximizing Returns in a Changing Market

The core concept of “short-term wallnut investing” – while not a formally recognized financial strategy – likely refers to short-term investments in assets perceived as volatile yet potentially offering quick, significant returns. This necessitates a deep understanding of market dynamics and risk management, far beyond a simple buy-low-sell-high approach. Let’s analyze potential asset classes, strategies, and risk mitigation techniques relevant to such a strategy.

Potential Asset Classes:

- High-Growth Tech Stocks: These represent a prime example, given their susceptibility to rapid price swings driven by news, earnings reports, and broader market sentiment. However, the inherent volatility demands careful timing and risk assessment. Consider the example of a company announcing a groundbreaking new product; its stock price might surge immediately, presenting a window for short-term profit. Conversely, a negative earnings report could lead to a rapid decline, highlighting the importance of exit strategies.

- Cryptocurrencies: The crypto market is notorious for its volatility. Short-term trading here involves exploiting price fluctuations based on news, regulatory changes, or market trends. However, the inherent lack of regulation and the susceptibility to manipulation necessitate rigorous due diligence and risk management. The 2021 Bitcoin bull run and subsequent crash serve as a stark reminder of the potential for both enormous gains and devastating losses. Statistical analysis of historical volatility (e.g., using standard deviation) is crucial before entering such a market.

- Futures and Options Contracts: These derivative instruments allow leveraged exposure to underlying assets, magnifying potential profits (and losses). Sophisticated strategies like scalping (very short-term trades) or day trading can be employed, but require exceptional market knowledge and technical analysis skills. A case study of a successful day trader might reveal their use of indicators like RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) to identify optimal entry and exit points. However, it’s crucial to remember that losses can escalate rapidly with leverage.

- Forex (Foreign Exchange) Market: Currency pairs exhibit constant fluctuations based on economic indicators, political events, and market sentiment. Short-term strategies here often involve identifying short-term trends using technical analysis and employing stop-loss orders to limit potential losses. The influence of geopolitical events, such as the 2014 Russian annexation of Crimea, dramatically impacted currency values, providing opportunities for short-term traders with accurate foresight.

Risk Management Strategies:

- Diversification: Spreading investments across different asset classes reduces overall portfolio risk. Allocating capital across high-growth stocks, cryptocurrencies, and forex can mitigate losses in one area if another underperforms.

- Stop-Loss Orders: These automatically sell assets when they reach a predetermined price, limiting potential losses. This is particularly crucial in volatile markets.

- Position Sizing: Careful calculation of investment amounts per trade helps prevent significant capital erosion from a single losing trade. This requires a thorough understanding of risk tolerance and potential loss scenarios.

- Thorough Due Diligence: Understanding the underlying factors influencing asset prices is crucial. This includes fundamental analysis (for stocks) and macroeconomic factors (for forex and crypto).

- Emotional Discipline: Panic selling or impulsive buying can be detrimental. Sticking to a pre-defined trading plan based on objective analysis is paramount.

Analytical Considerations:

- Time Horizon: The success of any short-term strategy hinges on accurately predicting short-term price movements. Longer-term market trends often become irrelevant.

- Market Sentiment: Understanding the prevailing investor sentiment (bullish or bearish) significantly influences asset price movements.

- Technical Analysis: Indicators like moving averages, RSI, and Bollinger Bands help identify potential trading opportunities based on price charts.

- News and Events: Significant news events (earnings reports, political developments, regulatory changes) often trigger rapid price fluctuations, which short-term traders need to anticipate.

Conclusion:

Short-term “wallnut” investing, while potentially lucrative, is exceptionally high-risk. Success requires not only a deep understanding of market dynamics and technical analysis but also rigorous risk management and exceptional discipline. The information provided should not be taken as financial advice; thorough research and, ideally, consultation with a qualified financial advisor are essential before undertaking any investment strategy. Any such strategy should be rigorously backtested and ideally validated through simulations or hypothetical trading before employing real capital.