Unlock Your Investment Potential: A Strategic Guide to Wallnut Investing

The world of investing can feel like a dense forest, full of jargon and complex strategies. But what if we told you there’s a path, a surprisingly simple yet powerful approach, to navigating this landscape? We introduce you to Wallnut Investing – a unique methodology that leverages the power of diversification and long-term vision, allowing you to cultivate your financial growth steadily and securely.

What is Wallnut Investing?

Forget chasing quick wins and risky gambles. Wallnut Investing is rooted in the principle of sustainable growth. Imagine a wallnut tree – strong roots anchoring it firmly, steadily producing valuable fruit over many years. This is the essence of our approach. We focus on building a diversified portfolio of assets, carefully selecting investments that offer both growth potential and risk mitigation. It’s about planting seeds today to harvest a bountiful future.

The Core Pillars of Wallnut Investing

Our strategy rests on three crucial pillars:

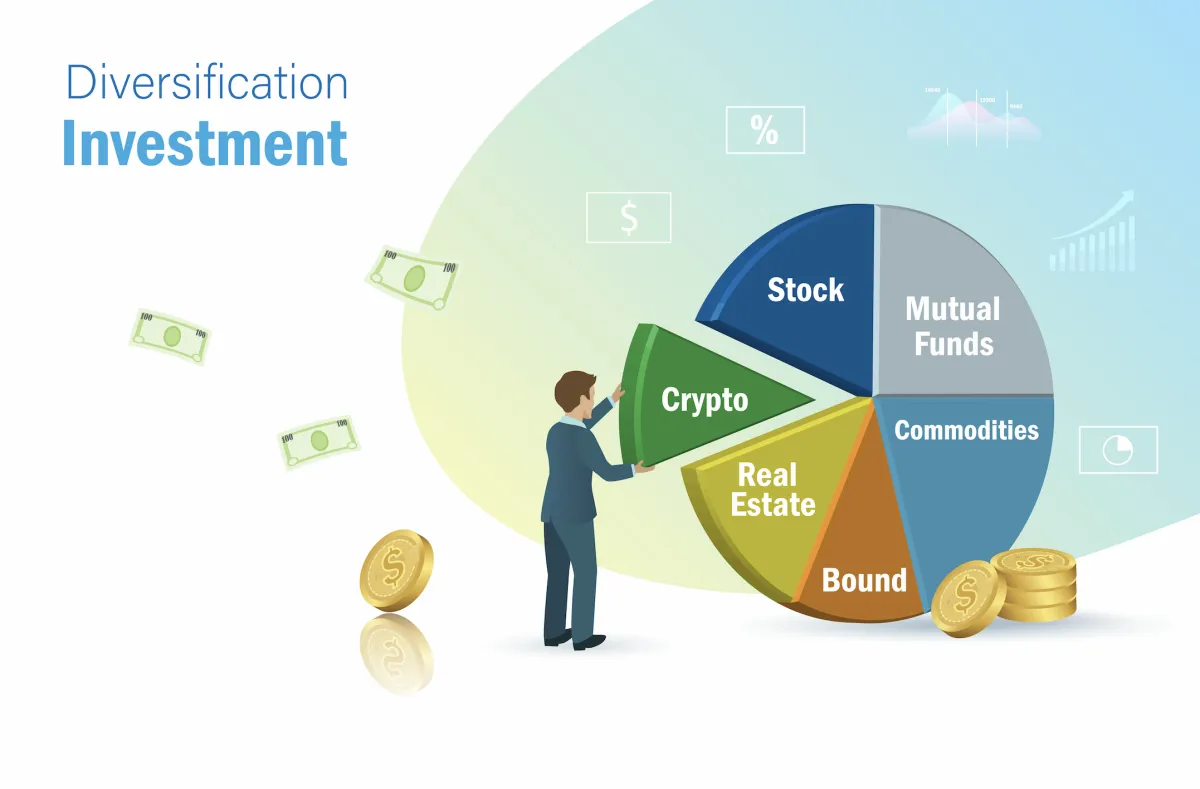

1. Diversification: Don’t Put All Your Eggs in One Basket

Wallnut Investing advocates for a well-diversified portfolio. This means spreading your investments across various asset classes to minimize risk. Think of it like the branches of a wallnut tree, reaching out in different directions, ensuring resilience even in adverse conditions.

| Asset Class | Example |

|---|---|

| Stocks | Index Funds, ETFs |

| Bonds | Government Bonds, Corporate Bonds |

| Real Estate | REITs, Rental Properties |

| Commodities | Gold, Silver |

2. Long-Term Vision: Patience is Key

The wallnut tree doesn’t bear fruit overnight. Similarly, Wallnut Investing requires patience. We focus on the long-term growth potential of our investments, weathering short-term market fluctuations. This long-term perspective allows us to ride out market corrections and capitalize on sustained growth.

3. Strategic Rebalancing: Pruning for Growth

Just as a wallnut tree requires pruning to maintain its health and productivity, your investment portfolio needs periodic rebalancing. This involves adjusting your asset allocation to maintain your desired risk profile. Regular rebalancing ensures you’re not overexposed to any single asset class and helps capitalize on market opportunities.

Getting Started with Wallnut Investing

Embarking on your Wallnut Investing journey is simpler than you might think. Here’s a step-by-step guide:

- Define your goals: What are you saving for? Retirement? A down payment? Knowing your goals helps determine your investment timeline and risk tolerance.

- Assess your risk tolerance: Are you comfortable with potential short-term losses for the possibility of higher long-term gains? This determines your asset allocation strategy.

- Diversify your portfolio: Spread your investments across different asset classes, considering factors like your risk tolerance and investment goals.

- Invest regularly: Consistency is key. Establish a regular investment schedule, even if it’s a small amount, to benefit from the power of compounding.

- Rebalance periodically: Review and adjust your portfolio regularly (e.g., annually or semi-annually) to maintain your desired asset allocation.

- Stay informed: Keep up-to-date with market trends and economic news, but avoid impulsive decisions based on short-term fluctuations.

Beyond the Nuts and Bolts: The Human Element

Wallnut Investing is more than just a strategy; it’s a philosophy. It’s about cultivating a mindful approach to your finances, understanding your risk tolerance, and having the patience to watch your investments grow. It’s about building a secure financial future, one well-planned investment at a time.

Disclaimer:

This article provides general information about Wallnut Investing and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Additional Information

Deep Dive: Unlock Your Investment Potential: A Strategic Guide to Wallnut Investing

The core premise of “Unlock Your Investment Potential: A Strategic Guide to Wallnut Investing” – assuming “Wallnut” refers to a specific investment vehicle or strategy not yet publicly defined – needs clarification for a meaningful analysis. We’ll proceed by assuming “Wallnut Investing” represents a hypothetical, diversified investment strategy encompassing a blend of established asset classes and potentially innovative approaches. This allows for a detailed exploration of the principles such a guide might cover and their implications.

I. Diversification and Risk Management:

A successful “Wallnut” strategy likely emphasizes diversification across asset classes to mitigate risk. This might include:

-

Equities: A blend of large-cap, mid-cap, and small-cap stocks, potentially across different sectors (technology, healthcare, energy, etc.) and geographies (domestic and international). Portfolio construction would consider factors like market capitalization-weighted indices (e.g., S&P 500) or fundamental analysis to select undervalued companies. Example: A balanced portfolio might allocate 60% to equities, diversified across these categories, to capture growth potential.

-

Fixed Income: Bonds from various issuers (government, corporate, municipal) with different maturities to balance risk and return. This segment provides stability and income streams. Example: A 30% allocation to a mix of government bonds and high-quality corporate bonds would offer relative stability and predictable income.

-

Alternative Investments: This could include real estate investment trusts (REITs), commodities, or private equity, depending on the investor’s risk tolerance and investment horizon. These often offer diversification benefits but may have lower liquidity. Example: A 10% allocation to REITs might provide exposure to the real estate market and a hedge against inflation.

The “Wallnut” guide should deeply analyze the correlation between these asset classes. Low correlation between asset classes is crucial for effective risk reduction. During market downturns, assets with low or negative correlations can help cushion losses from other portfolio components.

II. Strategic Asset Allocation:

The guide should detail the process of determining the optimal asset allocation based on the investor’s risk profile, investment goals, and time horizon. This involves:

- Risk Tolerance Assessment: A thorough questionnaire and potentially a financial advisor consultation to gauge the investor’s comfort level with potential losses. Younger investors with longer time horizons often have higher risk tolerance.

- Investment Goal Definition: Clearly stating the objective (e.g., retirement savings, down payment, wealth preservation) influences asset allocation. Long-term goals typically allow for greater risk-taking.

- Time Horizon: Longer time horizons permit a more aggressive approach, while shorter horizons necessitate greater emphasis on capital preservation.

III. Tactical Asset Allocation and Market Timing:

While the core “Wallnut” strategy emphasizes long-term strategic allocation, the guide might also discuss tactical adjustments based on market conditions. This is a more complex and less predictable area. It should carefully delineate the potential benefits and risks of market timing. Statistical analysis of historical market data can demonstrate the challenges of consistently successful market timing.

IV. Tax Optimization Strategies:

The guide must address tax implications of various investments. Understanding tax-advantaged accounts (like 401(k)s and IRAs) is crucial for maximizing returns. Strategies like tax-loss harvesting might be included.

V. Monitoring and Rebalancing:

Regular monitoring of portfolio performance and rebalancing to maintain the target asset allocation are critical components. A schedule for rebalancing (e.g., annually or semi-annually) should be recommended, alongside clear thresholds for triggering rebalancing actions.

VI. Ethical and Sustainable Investing:

The “Wallnut” guide might incorporate discussion of Environmental, Social, and Governance (ESG) factors, allowing investors to align their investments with their values. This increasingly important aspect requires an understanding of ESG rating methodologies and the potential trade-offs between ethical considerations and financial returns.

In conclusion, a comprehensive “Wallnut Investing” guide needs to go beyond basic investment principles. It should offer a deep understanding of risk management, diversification, strategic and tactical asset allocation, tax optimization, and the ongoing monitoring and rebalancing crucial for long-term success. The inclusion of case studies illustrating the application of these principles in diverse market scenarios would significantly enhance its practical value. Finally, the hypothetical nature of “Wallnut” necessitates a robust framework applicable to various investment vehicles and adaptable to evolving market conditions.