Wallnut Portfolio Optimization: 3 Strategies for Maximum Growth

The investment world is a sprawling orchard, laden with the potential for bountiful harvests – but only if you know how to cultivate your portfolio. Ignoring strategic pruning and careful grafting can lead to a meager yield. This is where Wallnut Portfolio Optimization comes in, offering a fresh perspective on maximizing growth. Forget the tired tropes of “buy and hold” – Wallnut offers dynamic strategies that adapt to the ever-changing market landscape.

This article explores three innovative Wallnut strategies designed to help you nurture your financial garden and reap substantial rewards.

Strategy 1: The Adaptive Acorn Strategy (Low-Risk, Steady Growth)

This strategy mirrors the resilience of an acorn – small but possessing immense potential. It prioritizes long-term, steady growth over aggressive, short-term gains. Ideal for risk-averse investors, the Adaptive Acorn Strategy focuses on diversification across multiple asset classes, emphasizing low-volatility investments.

Core Principles:

- Diversification is King: Spread your investments across a broad range of assets including bonds, index funds, and real estate investment trusts (REITs).

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly, regardless of market fluctuations, mitigating the risk of buying high and selling low.

- Regular Rebalancing: Periodically adjust your portfolio’s asset allocation to maintain your desired risk profile.

| Asset Class | Allocation (%) | Risk Level |

|---|---|---|

| Index Funds | 40 | Low |

| Bonds | 30 | Low |

| REITs | 20 | Moderate |

| Emerging Markets | 10 | Moderate-High |

This strategy isn’t about chasing the next hot stock; it’s about building a robust foundation for long-term wealth creation. While returns may be slower initially, the consistent growth and lower risk make it an excellent choice for building a secure financial future.

Strategy 2: The Dynamic Sprout Strategy (Moderate Risk, Accelerated Growth)

The Dynamic Sprout Strategy is for investors willing to take on moderate risk for potentially higher returns. It emphasizes a more active approach to portfolio management, leveraging market opportunities and adjusting the strategy based on market trends and personal circumstances.

Core Principles:

- Strategic Asset Allocation: A more aggressive allocation towards growth stocks and other higher-risk assets.

- Tactical Asset Allocation (TAA): Shifting investment allocation based on market forecasts and economic indicators.

- Active Fund Management: Investing in actively managed funds aiming to outperform market benchmarks.

| Asset Class | Allocation (%) | Risk Level |

|---|---|---|

| Growth Stocks | 45 | High |

| Index Funds | 25 | Low |

| Emerging Markets | 20 | Moderate-High |

| Bonds | 10 | Low |

This strategy requires more diligent monitoring and a deeper understanding of market dynamics. The potential for higher returns comes with increased volatility, making it suitable for investors with a longer time horizon and a higher risk tolerance.

Strategy 3: The Bountiful Harvest Strategy (High Risk, High Reward)

This is a strategy for the adventurous investor, akin to planting a rare, high-yield crop. The Bountiful Harvest Strategy embraces higher risk in pursuit of significant returns. It’s not for the faint of heart, but for those willing to weather market storms, the potential rewards are substantial.

Core Principles:

- Concentrated Investments: Focusing on a smaller number of high-growth stocks or other alternative investments.

- Leverage: Utilizing borrowed funds to amplify potential returns (requires caution and careful planning).

- Active Trading: Frequent buying and selling of securities based on short-term market movements.

| Asset Class | Allocation (%) | Risk Level |

|---|---|---|

| Growth Stocks | 60 | High |

| Alternative Investments | 30 | Very High |

| Cash | 10 | Low |

This strategy demands extensive market knowledge, rigorous risk management, and a strong stomach for volatility. While the potential for substantial growth is high, the risk of significant losses is equally significant. It’s crucial to have a well-defined exit strategy and a thorough understanding of your risk tolerance before embarking on this path.

Disclaimer: This information is for educational purposes only and should not be considered investment advice. Consult with a qualified financial advisor before making any investment decisions. The potential for profit is accompanied by the risk of loss.

Additional Information

Wallnut Portfolio Optimization: A Deeper Dive into 3 Strategies for Maximum Growth

The core concept of Wallnut portfolio optimization – focusing on diversification, risk management, and strategic asset allocation – forms a solid foundation. However, a deeper analysis reveals nuanced considerations and potential pitfalls that warrant attention. Let’s delve into each strategy with increased analytical rigor:

1. Diversification: Beyond Simple Asset Class Allocation

While the article likely advocates diversifying across asset classes (stocks, bonds, real estate, etc.), true diversification extends far beyond this superficial level. Effective diversification requires a granular approach considering:

-

Geographic Diversification: Investing solely in US equities exposes the portfolio to the specific economic and political risks of the US. Global diversification, including emerging markets, can mitigate this risk, but requires a nuanced understanding of geopolitical factors and currency fluctuations. For example, a portfolio heavily weighted towards emerging markets might experience higher volatility but potentially higher returns than a purely US-focused portfolio. The allocation needs careful consideration based on the investor’s risk tolerance and time horizon.

-

Sector Diversification: Concentrating investments within a single sector (e.g., technology) introduces significant sector-specific risk. A downturn in the technology sector can severely impact a portfolio lacking diversification across various sectors (healthcare, energy, consumer staples, etc.). Analyzing sector correlations and their historical performance against broader market movements is crucial for effective diversification.

-

Factor-Based Diversification: Going beyond traditional asset classes, consider diversifying across factors like value, growth, momentum, and size. This approach aims to capture diverse market premiums rather than simply relying on asset class returns. For example, a value-oriented portfolio might invest in undervalued companies with strong fundamentals, potentially offering higher returns than a growth-focused portfolio during certain market cycles. However, factor-based investing requires a sophisticated understanding of factor models and their inherent limitations.

-

Correlation Analysis: A crucial aspect of diversification is analyzing the correlations between assets. Assets with low or negative correlations can cushion the portfolio during market downturns. For instance, gold often exhibits a negative correlation with stocks, acting as a hedge against equity market declines. Regular correlation analysis is vital for dynamic portfolio adjustments.

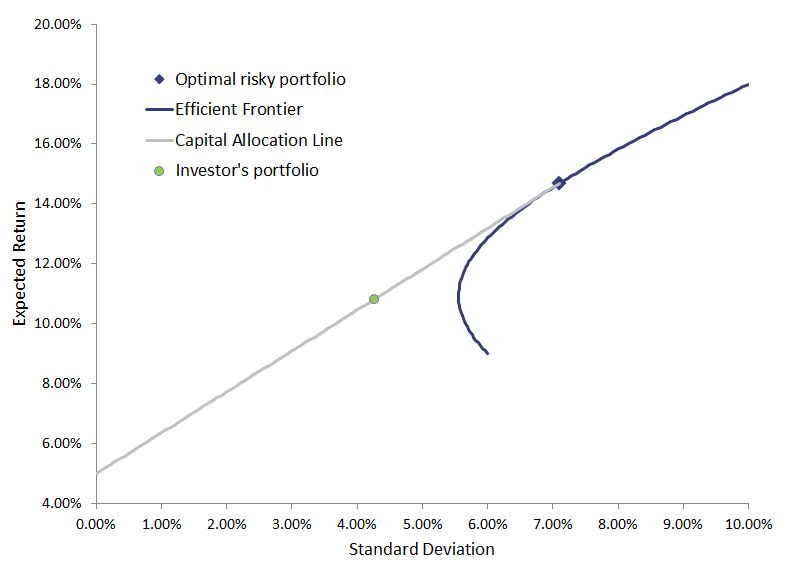

2. Risk Management: Beyond Standard Deviation

Standard deviation, while a common measure of risk, provides an incomplete picture. A more comprehensive risk management strategy necessitates considering:

-

Tail Risk: Standard deviation primarily focuses on the typical fluctuations of returns. However, it underestimates the potential for extreme negative events (“tail risk”), which can severely impact portfolio value. Strategies like using options or downside protection strategies (e.g., protective puts) can mitigate tail risk.

-

Drawdown Analysis: Analyzing the maximum percentage drop in portfolio value from a peak to a trough (drawdown) provides a better understanding of the portfolio’s resilience to market downturns. Investors with a lower risk tolerance should prioritize portfolios with historically lower maximum drawdowns.

-

Stress Testing: Simulating different market scenarios (e.g., recession, geopolitical crisis) helps assess the portfolio’s robustness under various adverse conditions. This allows for proactive adjustments to reduce potential losses.

-

Liquidity Risk: The ability to quickly convert assets into cash is critical. Overlooking liquidity risk can lead to forced selling during market downturns, exacerbating losses. A well-managed portfolio considers the liquidity characteristics of each asset.

3. Strategic Asset Allocation: Dynamic vs. Static

The article may present static asset allocation, where the portfolio’s asset allocation remains relatively constant over time. However, a more sophisticated approach involves dynamic asset allocation:

-

Tactical Asset Allocation: This involves adjusting the portfolio’s asset allocation based on market forecasts and short-term opportunities. This approach requires active management and market timing skills, which are notoriously difficult to master consistently.

-

Mean Reversion Strategies: These strategies exploit the tendency of asset prices to revert to their long-term averages. They might involve increasing allocations to underperforming assets or reducing allocations to overperforming ones, betting on mean reversion to generate alpha. However, market timing requires careful analysis and an understanding of market cycles.

-

Rebalancing: Periodically rebalancing the portfolio to restore the target asset allocation is crucial. This involves selling assets that have outperformed and buying assets that have underperformed, bringing the portfolio back to its desired risk profile. Rebalancing can enhance returns and manage risk over the long term.

Conclusion:

While the core principles of diversification, risk management, and strategic asset allocation are essential for portfolio optimization, a deeper dive reveals intricate considerations and advanced strategies. A robust Wallnut portfolio necessitates a nuanced understanding of these complexities, coupled with a thorough analysis of individual investor risk tolerance, time horizon, and financial goals. Ignoring these nuances can lead to suboptimal performance and increased risk. The use of sophisticated tools, including portfolio optimization software and professional financial advice, can significantly enhance the effectiveness of these strategies.